CLAP-IT Instructor Led Training

- Network Lab’s has developed an unique induction program called CLAP-IT and trained over 5000 people.

- CLAP-IT is a unique induction program designed and developed by industry expert to meet the organisation expectation.

- CLAP-IT program intends to impart Foundation level skills required for IT-Infrastructure Management Skills

- CLAP-IT is a case study driven programme designed for students aspiring to gain a foothold in the IT Infrastructure Management Services industry as a Level 1 Engineer.

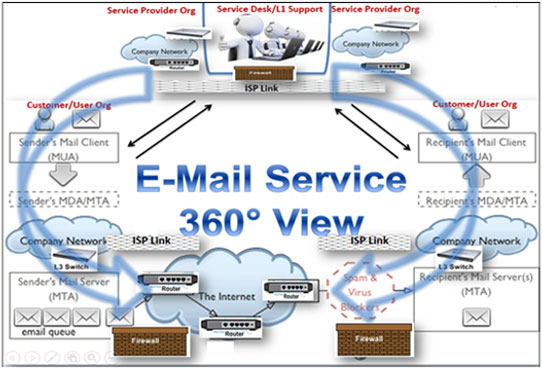

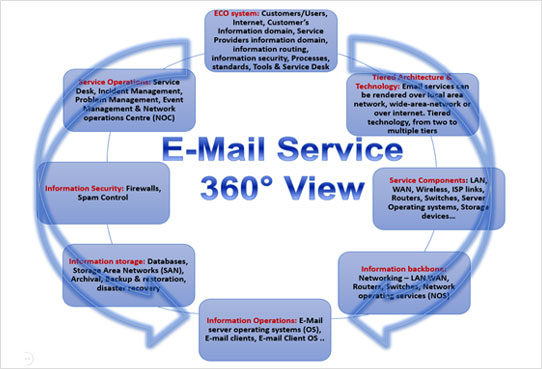

- CLAP-IT is learning framework includes 360 hours of study material and imparts training in foundation level skills with a 360-degree view of IMS Eco system.

Targeted Audience

- Masters (MTech)

- Under-graduates(Diploma)

- Graduates (BE, BTech, B.Sc, BCA)

- Speciation in Computer Engineering, Computer Science, Information Science, Electronic and Communication(E&C).

Our SME’s

Our campus is stretched over 60,000 sq. Ft in the IT hub, Whitefield, Bengaluru, Silicon Valley of India.

Our campus includes State-of-the-art facilities like: –

- Software development centres,

- Eight training classrooms,

- Data Centres,

- Remote Labs,

- Content development studios,

- Innovation labs,

- Huge Incubation centre,

- Break out areas,

- Huge executive dining area,

- Gym and sufficient Parking lot.

1.0 SEVA BANK – at your service!

SEVA Bank has been operating in Banking and Financial services sector for more than three decades. Established in late 1980s by visionary Krishna Pai, with good customer base, had been grown by 15%-20% year-on-year till about couple of years. In the last financial year bank’s revenues were around Rs. 550 crores with non-performing assets (NPA) being just about 2.5%, which is a good situation considering the sector. The Bank operates in almost all cities and towns across the country and has major presence in tier 2 cities/towns. It caters to both Retail and Corporate customers with over 200 branches across the country and head office in financial capital Mumbai’s Andheri east.

1.1 Bank’s USP

Apart from customer friendly financial instruments like fixed deposits, loans etc., customer service was considered to be one of the best in the segment. Customers could get their query answered through phone or walk into one of their branches with very quick turn around times – they could be assured of warm welcome and a broad smile! The employees would not hesitate to go that extra mile to serve the customer and the bank had the track record of no customer being turned away without service.

1.2 Business Challenges

However, over the last couple of years bank had seen a decline in its revenue growth by 5%-10% in the Retail segment (Personal banking), which was cause of concern to the management. Though there was no reduction in customer base, the retail banking had not kept up with the growth of earlier years. This was tricky as the bank had very good reputation in banking and financial services domain both in terms of services and financial instruments.

1.3 Management

Krishna Pai had steered the bank right from its inception till about last decade as CEO and Managing Director. Under his leadership bank had grown from 0 to Rs. 250 crores in terms of revenue. He had handed over to his son Ram Pai who had taken over the business in year 2000 and moved on as Chairman of the Bank. The bank had withered through two meltdowns, one caused on “dotcom” and the other due to housing loan in US.

Ram Pai did most of his education in US with masters in business from Harvard. He had also acquired work experience working with one of biggest Banks in US for about 5 years. He had come back to India to take over from his father with lot of new ideas on business growth. He was completely proInformation Technology (IT) and strongly believed that IT was not just “MIS”. In his view, IT was more strategic and part of overall business strategy. He was methodical in approach and would not show any ‘knee-jerk’ reactions.

Where are we now?

It was Board room meeting with Krishna Pai as the chairperson. Along with him were Ram Pai, CEO and MD, SurendraNaik, Independent Director, Ashwath Kamath and Nagaraj Poojari, Directors. All of the directors had over two decades of experience in Banking and were considered to be industry experts.

Krishna Pai started the meeting with the agenda. Clearing his throat, he said “Bank has been witnessing good growth till about couple of years. Numbers reveal that the growth has declined by 5% in retail segment. This is cause of concern given that our bank’s services are rated best in the sectors that we operate. Now we will have to look at the solution part which is more strategic. Over to you” pointing at Ram Pai. Ram Pai started of the meeting proceedings “Thank you gentlemen for having made it to this meeting at a very short notice! Before I could go on with my assessment, I would like to get views and opinions of other directors on this matter”, looking at other directors.

Other Directors started airing their views from their experience and some of them made sense. Ram Pai listened to them carefully, noting down the points where ever required. At the end, he rose from his seat started presenting the case, considering the inputs from all others.

Where do we want to be?

“We have a very good name in the market and none can deny that! However, decline in the revenues in retail segment is surprising. When I looked around services that we provide, I could understand where the retail customer is coming from”. He paused for a while and looked around to understand the reaction from other directors. He continued “ with Information technology growing and changing everyday, it is hard to think that the customers (read retail) would still have to call or walk-into our branches for the queries. Mind the traffic and time that they have to spend! Phone call was an alternative. However, availability of bank personnel during the call has also been issue. With lifestyles changing, customer may not want to wait on phone or walk-into our branches to get the information. It should be available for him over the net! The competition is already on it and we should not be left behind. This is the reason why our retail customers are finding our services, though are good, slow! In my opinion, we will have to take Banking services to next level, more technology driven. We should look at IT as strategic Asset and make use of it to move to the next levels.

Assignmentand Assessment

- Assignment: At the end of each lesson candidates will undergo quizzes which helps to assess comprehension. At the end of each module participants will undergo presentation on a particular topic which will be assigned to them.This enhances their presentation skills.

- Assessment: During the training, all candidates arerequired to undergo Assessments, which includes scenario based Multiple choice questions(MCQ) followed by Practical Assessment for practical exposure.